Introduction

As was the theme of a previous post, the goal of this post is to perform quantitative analyses of several personal finance areas. Previously, I looked into the real cost of paying down debt first, a-la the Dave Ramsey method. In this post I will consider the options of what to do once you have paid off those debts. After contributing 15% of your income to retirement and saving a 20% down payment for a home, additional money can be put into either additional principle payments on your home “Home First”, or placed into a taxable investment account “Investment First”.

The math problem is simple–it will be better for the numbers to invest these funds where the higher rates of return are. Generally, a taxable investment in such as in mututal funds or ETFs (7%+ returns generally) will be better than paying additional principle on your home mortgage (<5% interest generally). My goal here is to put a dollar value on the upside; this can help to place a value on the higher risk equity investment route.

Results

Pay off the House vs. Investing

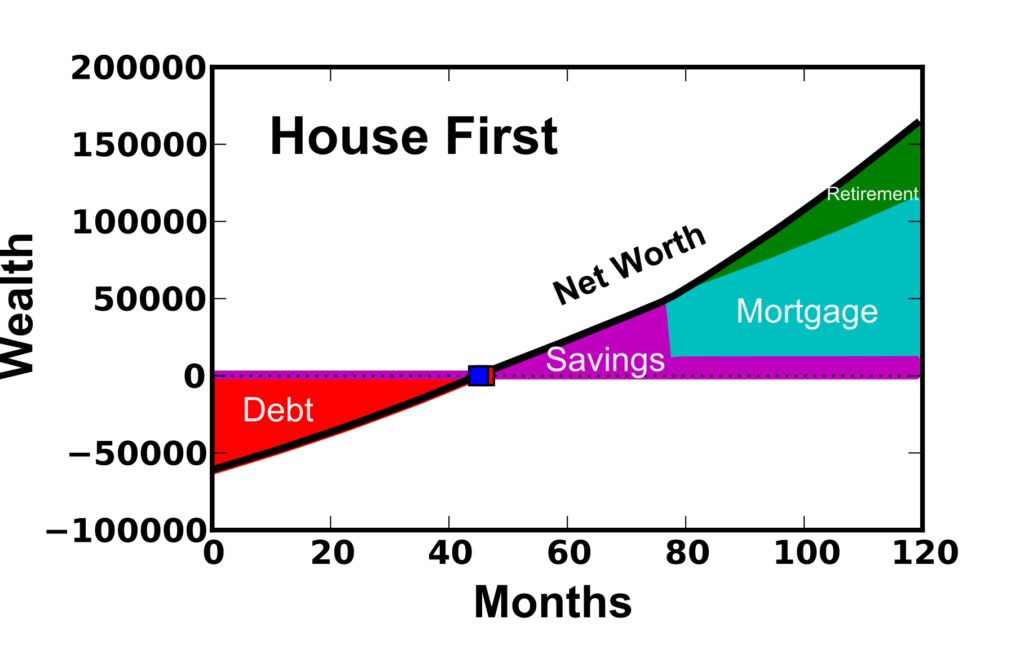

Assumptions were made with respect to income, expenses, etc. as described in a previous post. Figure 1 shows the 10 year net worth calculation given that the priority is to pay the house off first (while at the same time saving 15% to retirement). This can be compared to the distribution of net worth shown in Figure 2 where the minimum payment is made on the 15 year mortgage, and additional savings is placed in after-tax investments (assuming 7% annual return). In these calculations, an initial debt load is paid off over the first 4 years. Afterwards, an emergency fund and mortgage down payment (20% of 200k house) is saved. This calculation only accounts for a relatively short timeline of only 4 years of home ownership (home purchased once a down payment was saved at month 77).

Figure 1: House First option where a 15 year mortgage is paid with priority once the house is purchased. Retirement savings of 15% of income also occurs.  Figure 2: Investment First option where a 15 year mortgage is paid with priority once the house is purchased. Retirement savings of 15% of income also occurs.

Figure 2: Investment First option where a 15 year mortgage is paid with priority once the house is purchased. Retirement savings of 15% of income also occurs.

As expected, the “investment first” option comes out ahead by ~$1800 after this 10 year period (after-tax net worth $152,900 vs. $151,100). While this is not a small amount of money, it is not a significant amount in the grand scheme of things (only ~1.2% greater net worth). There are fair arguments on both sides. “House First” folks may prefer this option because they are particularly debt-averse or that they are worried they would spend the extra money if they kept it in cash. The “Investment First” option makes sense for people who are investing for a longer time-frame and may be interested in having the money more accessible (not tied up in the illiquid mortgage).

15 vs. 30 Year Mortgage

One additional calculation was performed to assess the mortgage length of 15 or 30 years. Previous calculations were performed with a 15 year mortgage, but some people may prefer leveraging their debt load and re-investing the saved money. However, because the interest rates on 15 year mortgages tend to be lower (I used 2.5% interest rate for the 15 year rather than a 3.375% for the 30 year loan), the interest payments will be quite a bit larger when a 30 year loan is taken. Figure 3 shows the 10 year, after-tax net worth for the 15 year mortgage where the “House First” option is chosen vs. the 30 year mortgage where the extra money is paid to investments using the “Investment First” option.

Interestingly, the 15 year “House First” net worth still increases with investment rate of return because of the retirement contribution. However, it is clear that for investment returns greater than ~10%, the 30 year “Investment First” option is more attractive. Now over its lifetime, the S&P 500 has >10% average annual rate of return (for long term investments), and so generally the 30 year “investment first” option will be better. However, in the short term, the variability of the returns make this far from a guarantee and highly dependent on market conditions. Because of the “personal” aspect of personal finance, the decision to choose one option vs. another should be made by each individual.

Figure 3: Comparing a 15 year (House First) and 30 year mortgage (Investment First) with investment preference as a function of the investment return.

Figure 3: Comparing a 15 year (House First) and 30 year mortgage (Investment First) with investment preference as a function of the investment return.

Conclusions

Even though the “Investment First” option leads in these simulations, the difference is less than $2000 (out of ~$150k for this 10 year period). A large portion of this 10 year period was spent paying off debt and saving for a down payment, so the differences will become larger over longer time periods. Ultimately, this decisions should come down to whether you would prefer a guaranteed, illiquid return by investing in your mortgage, or a riskier (certainly in the short term) but more easily accessible investment in the stock market.